Value Tilt

Since last Friday (May 22, 2020), there has been a development of an interesting trend, a potential migration of capital from winners into losers.

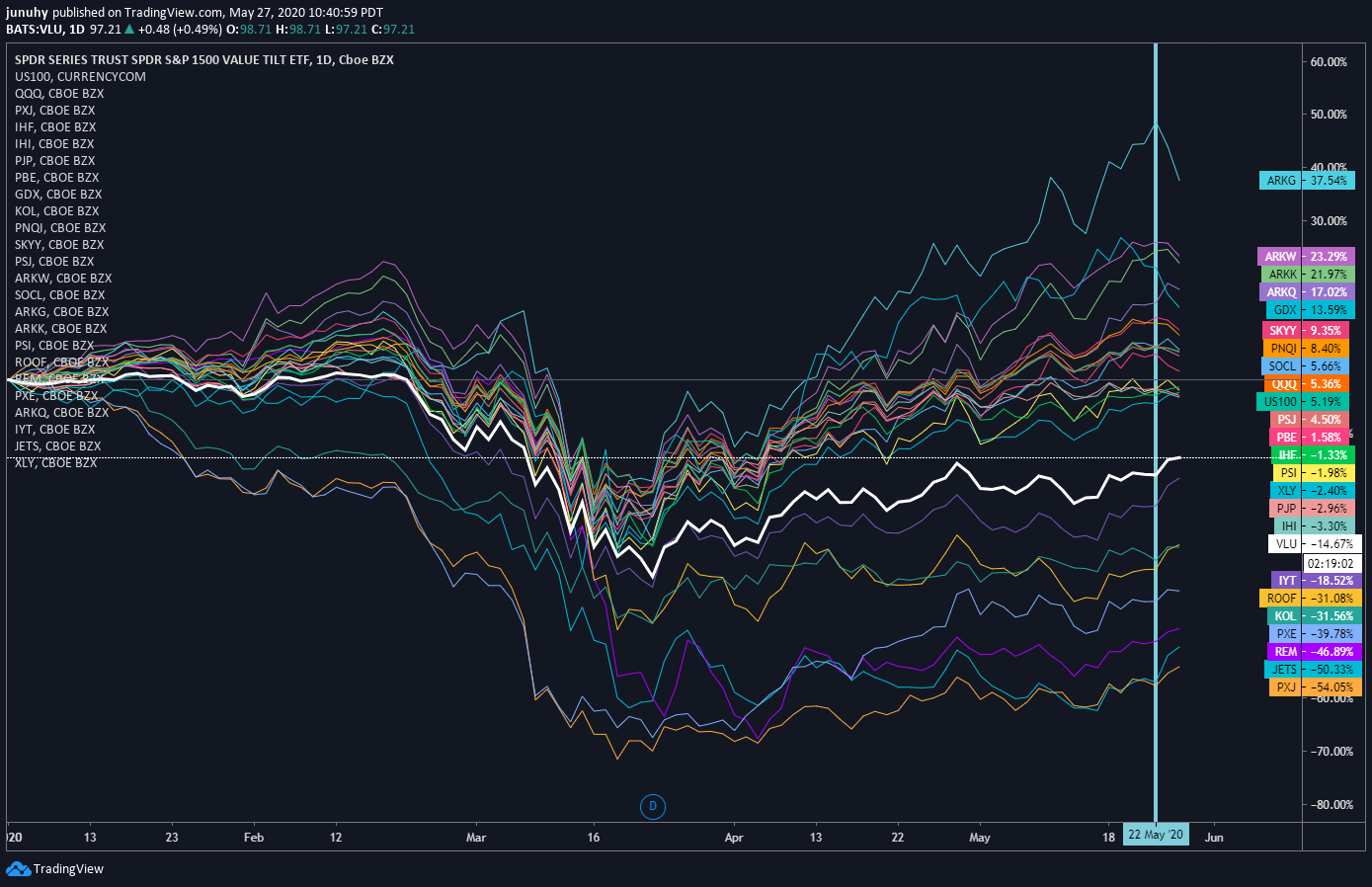

<Chart 1> compares YTD trend of ETFs of my interest. The overarching trend since the COVID-19 induced crash was the stability of gold and gold-related stocks, outperformance of bio/pharmaceutical, life science, internet and contact-free/emergency-related stocks. Most of the outperforming stocks, especially IT stocks, maintained their positions as large-cap, thrusting the momentum of QQQ and SPY, market-cap weighted indices, while DJI, an equal-weighted index, underperformed.

From May 22, 2020, however, the best performing ETFs, such as ARKG (ARK Genomic Revolution ETF), ARKW (ARK Next Generation Internet ETF), GDX (VanEck Vectors Gold Miners ETF), and SKYY (First Trust Cloud Computing ETF), began to reverse in trend. Contemporaneously, the underperforming/oversold sector ETFs, such as JETS (US Global JETS ETF), PXJ (Invesco Dynamic Oil & Gas Services ETF), REM (iShares Mortgage Real Estate ETF), IYT (ishares Transportation Average ETF), and XLY (Consumer Discretionary Select Sector SPDR Fund), have reversed upwards.

Momentum Crash

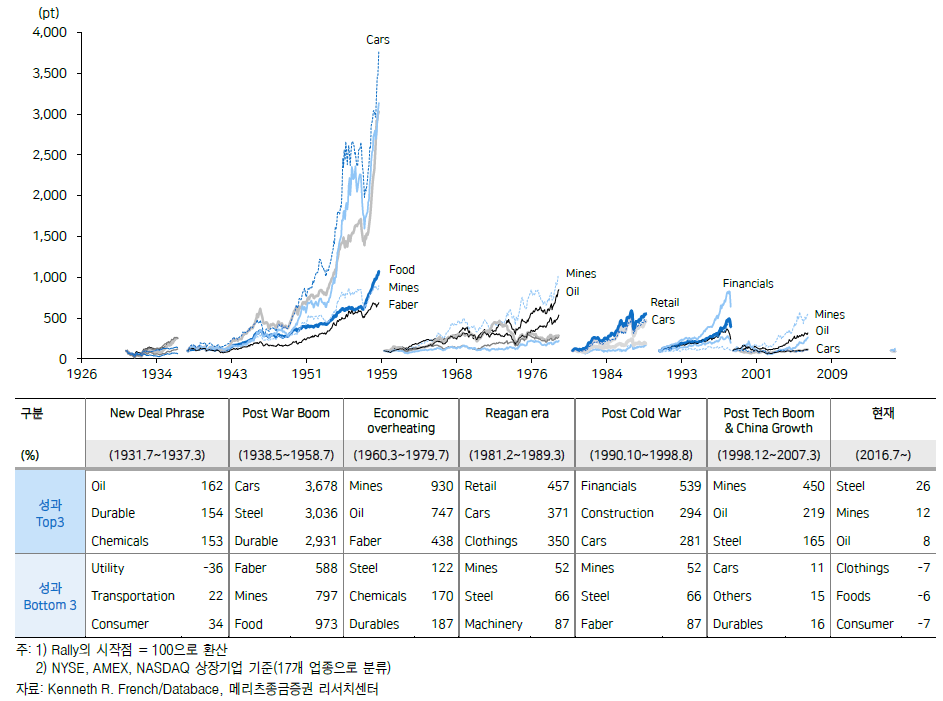

Another notable trend is this week's value ETFs (VTV, VLU) outperformance in comparison to momentum ETF (IMTM, MTUM). This is notable in that momentum stocks or the winners have already restored or exceeded their historical highs, while underperformers that may well withstand COVID-19 crisis are extremely undervalued. This poses a stark gap in potential returns on investments, and may induce migration of investment capital from momentum stocks into value stocks.

AQR's paper coins such phenomenon as "Momentum Crash".

"Despite their strong positive average returns across numerous asset classes, momentum strategies can experience infrequent and persistent strings of negative returns. These momentum crashes are partly forecastable. They occur in panic states, following market declines and when market volatility is high, and are contemporaneous with market rebounds." - Momentum Crash by Kent Daniel, Tobias J.Moskowitz

It is too early to tell whether or not this week's reversal is a signal to the beginning of momentum crash; if true, it may provide a great opportunity to rebalance portfolios with a value tilt.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

JWH 05/27/2020

'Analysis > Market Monitor' 카테고리의 다른 글

| 【ETF Trends】Signs of Value Tilt? (2) (0) | 2020.06.04 |

|---|